2.3.1 DR related company competitiveness analysis

DR (digital X-ray machine) is mainly composed of X-ray tube, X-ray high-voltage generator, digital sensors, mechanical parts and image system, etc. Domestic more than a certain scale of DR factory has more than 40, the competition is very fierce. Most manufacturers use OEM mode, namely the purchase related parts for assembly (similar to the computer assembly), they lack the technical core competitiveness. Only a handful of core components can realize the localization of the DR manufacturers, this kind of manufacturer will dominate in the market competition.

From the point of the whole machine, digital detector is the most important part of DR, determines the image quality of the product. In our country only lm Wilson of science and technology, Shanghai, jiangsu kang, DE embellish the design and production capacity.

High voltage generator is another core component of the DR, it can automatically according to the imaging area parameters such as attenuation state adjust kV and mA, keep the X-ray tube best load state. Domestic enterprises, only the lm science and technology, guangxi jung dragon, DE embellish pl has the independent production ability of the device.

X-ray tube ball is DR third core parts. Only lm technology in domestic and hangzhou kailong with ball tube production capacity.

In conclusion, lm science and technology is the only has all the core components of domestic manufacturers of DR independent research and development ability of enterprises, thus ensuring its products of low cost, stable quality, good after-sales service, in the state supports the backdrop of the excellent domestic medical equipment, is expected by implementing import substitution and rapid growth.

Equipment industry investment in the main line 2: systematic platform

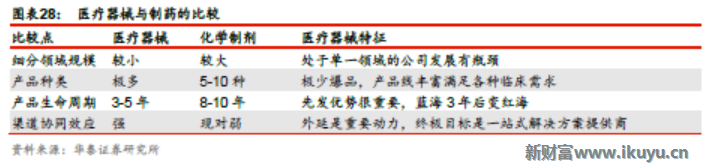

Device companies and drug companies development path is different, its essence is caused by different industry characteristics. Niche for medical devices industry very much, but each market space is not large, in the field of upgrading and short product life cycle. Often a competitive landscape good niche, 3 to 5 years from the red sea blue ocean. This decision any instrument in the field of single segment leading company in three to five years growth there will be a bottleneck (unlike drug companies often rely on one or two exclusive big varieties can be stable growth of more than 5 years). On the other hand, the terminal customers, such as hospitals, need a lot of different categories and specifications of the equipment, they want to docking can provide one-stop solution for equipment manufacturers or dealers.

This determines the best medical equipment company is the development path of import substitution of niche, rich product line and strengthen channel advantages through epitaxial acquisition, into can provide one-stop solution for terminal customers type platform vendors. In market, for example:

First stage companies rely on import substitution cardiovascular stents rapid development, form a stable cash flow. When hit growth in the field. The company into the next phase.

The second stage, the company with the help of cardiovascular stents business accumulated channel advantage, denotative development. Through mergers and acquisitions pacemaker, valve, pipe, such as vascular ZaoYingJi equipment and consumables, built the cardiovascular devices field one of the most abundant product line, compared with the first stage, building a stronger competitive advantage. When cardiovascular equipment market space constitutes a bottleneck on company growth again, the company to enter the third stage.

The third stage, the company actively seeking instrument and the development of cardiovascular outside space. In the aspect of equipment, the company will expand into surgical minimally invasive surgical instruments, hemodialysis and precise medical field. In the aspect of the equipment, the company with the help of the original business and channel advantages, will expand into cardiovascular drugs and cardiovascular health, cardiovascular hospital, thus to build the domestic only cardiovascular the whole industrial chain platform. Once again to enhance competitive advantage.

We think that the development of the market investment in the medical equipment company has a good reference. Also with overseas equipment leading companies, such as Johnson & Johnson, medtronic, etc., there are many similarities. We in the main line is one of a leading company in the field of each segment, in the future when they hit the original business, will inevitably by endogenous extension product diversification, covers in the field of single or multiple areas for hospital to provide one-stop solution.

To sum up, we will according to the stage of development of the company we recommend to classify the target, to provide the reference for the investors. The more the greater the company's growth potential of early, but also has a high investment risk. The more mature outbreaks continue increase the possibility of a small company, but the investment risk is small. We focus on recommend and diving medical market.

Focus on corporate investment

4.1 $market (SZ300003) $: big health the whole industry chain platform obvious competitive advantage

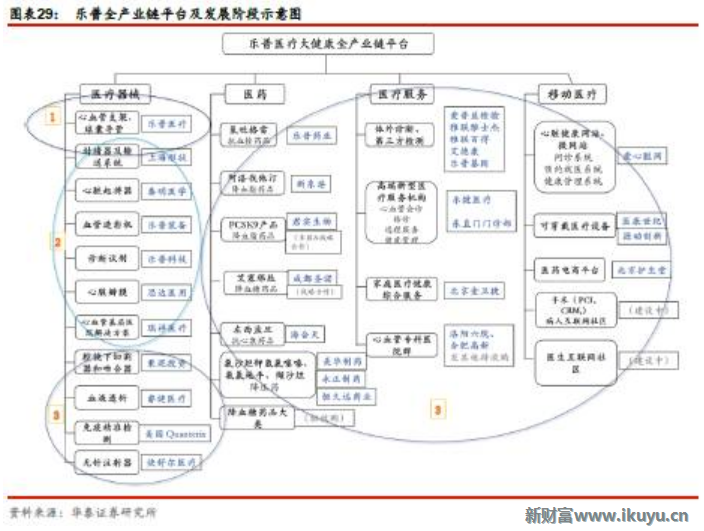

Cardiovascular devices leading enterprises and competitive platform. Company is a domestic leading enterprise in the field of cardiovascular devices, scale and rich product line is the company's advantage. Company for many years by endogenous extension to build the cardiovascular field the only set of medical equipment, medicine, medical services, mobile medical four one of the whole industry chain platform. In the short term is difficult to be replicated, has a strong core competitiveness. The company will always adhere to the platform strategy, has a broad space for development in the future.

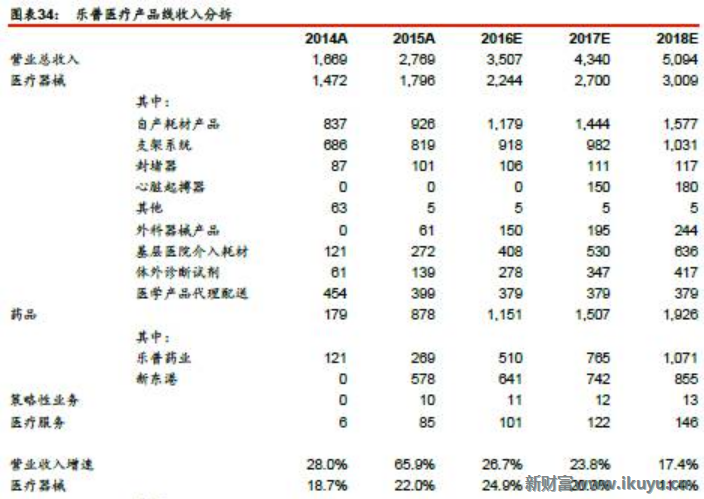

Equipment business steady growth, focus on biodegradable stents. Company is the domestic leader in the field of cardiovascular stents (market share ranking the second), the business will increase with the increase of PCI for, provide a stable cash flow. Mergers and acquisitions of IVD business, surgical stapling, and recently approved listing of dual chamber pacemaker in technology is leading in the domestic equipment, the competitive landscape is good, is the company's equipment plate main growth engine in the future. In the long term, biodegradable stent is expected to be listed on the 18 years, will give the company's future 3 to 5 years of sustained growth performance to provide guarantee, and as a catalyst for share price upward.

Drug business will maintain high-growth for 3 to 5 years. Drug income is mainly from Germany pharmaceutical (main products clopidogrel) and new donggang pharmaceutical (main products atorvastatin) contribution, clopidogrel and atorvastatin market space is large (both in 5 billion yuan of above), good competition (3-5 competition), low sales base (income) in 1-200 million yuan, is expected in the future also can maintain high-growth for many years. The layout of the company this year increased in the pharmaceutical sector, bought potassium chloride sand jotham hydrochlorothiazide, amlodipine, valsartan cardiovascular other big brands, etc. These varieties are expected to use the company's existing cardiovascular drug sales channels and measures. To this end, the company business growing uncertainty is high.

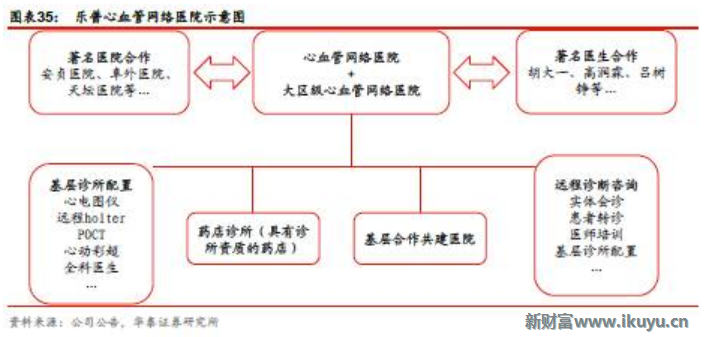

Layout of medical services, mobile medical enhance entire industrial chain platform advantage. With rich product line equipment, medicine support, the company actively layout cardiovascular hospital, mobile medical treatment and the terminal operations, to build the integration of upstream and downstream industry chain platform. At present, the company through cooperation with well-known experts and hospital cardiovascular network established Beijing hospital, future plans to invest to establish five provincial regional cardiovascular hospital (luoyang has acquired six yuan and hefei hi-tech cardiovascular specialist hospital), 1500 township clinic drugstore (has the construction of more than 200), forming a three-level cardiovascular health service system. The establishment of the system not only can promote the company equipment and business growth, and it will make difficult to replicate cardiovascular the whole industrial chain platform, competitive advantage is obvious.

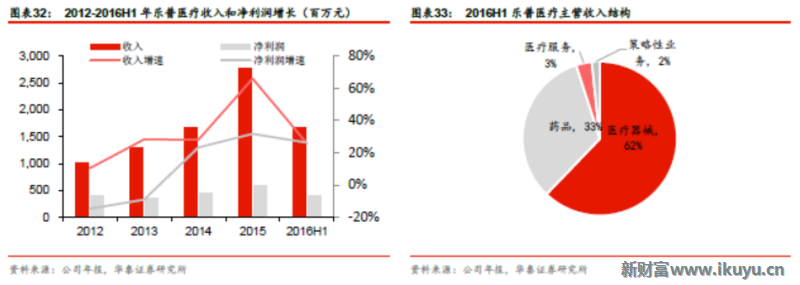

Competitive advantage obviously, big health the whole industry chain platform to "buy" rating. We forecast 2016-18 of EPS is RMB 0.67/0.39/0.52, respectively, belong to the female net profit 6.91/9.27/1.196 billion yuan, respectively, year-on-year growth of 33% / 34% / 29%, the current share price corresponding to 42/32 / PE 25 times. Considering the company's future earnings certainty high full industrial chain platform obvious competitive advantage, the company shall be given a certain premium valuation, we give the firm a EPS35 17 years - 40 times, the target price is $19-21, to "buy" rating.

Risk tip: consumable bidding price; Research and development of biodegradable stents progress not exceeding the expectation ".

$diving medical (SZ002223) $4.2: quality is good instruments

Investment point

Broad prospects for development, attractive valuations

The company is a leading domestic household medical equipment. Is the most abundant product line in the field of home appliance company. Oxygen generator, electronic sphygmomanometer, atomizer, and other key products in the domestic market share lead. Machinery group, to our company for 14 years acquired a wealth of product line of medical equipment and consumables (> 1300 registration certificate), through constantly explore the hospital make a household, medical apparatus and instruments marketing platform, the future development prospect. Company currently PETTM45 times, 17 years PE32 times, in the past three year low PETTM over the past three years (with the PEForward central is about 60 times and 40 times respectively). Company valuations are attractive, key recommendations.

|