Key products steady growth

16 years company focusing on high margin products. Among them, we expect the oxygen generator + 20% (more than expected, as Tibet contribute tens of millions of increment income), electronic sphygmomanometer income + 20%, + 70% glucose meter income, atomizer income + 15%, breathing machine revenues of more than 2000, surplus products remain stable, good overall performance. 16 q4 online needle contribute about 10 million income, 17 years is expected to grow rapidly and worthy of attention. The key product growth stability to ensure the long-term steady development.

Epitaxial mergers and acquisitions increase hospital channel product line

Company in domestic medical equipment channel has become a absolute leader, the next step strategic focus is the development of medical consumables. In the acquisition of medicine is the strategy propulsion. Thickening of optimal medicine not only in company performance, enrich the product line of channels in the hospital, and will realize the resource sharing between each clinical products of the company and promote, guarantee the rapid expansion of the company in the field of medical consumables. If medical channel products growth momentum, the company will continuously extension of mergers and acquisitions, so as to further enhance its household, medical sales channel platform of competitive advantage.

Quality is good instruments leading enterprises grow steadily, and "buy" rating

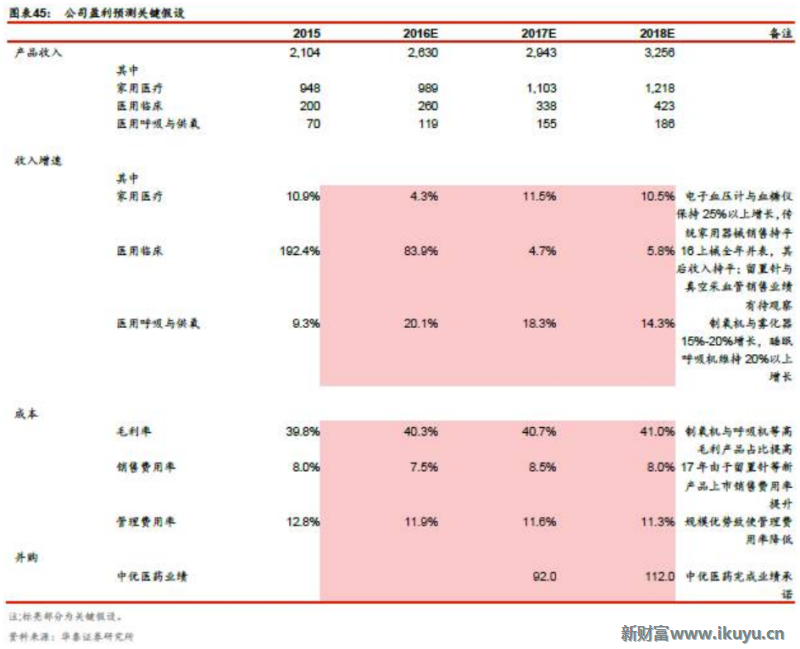

We predict the company core business of the existing 2016-18 annual income of 3.26 billion yuan / 26.3/29.4, belong to the mother net income for 690 million yuan / 5.0/6.0. In addition, assume that the new acquisition of optimal medical complete performance commitment (and table) in January 2017, the merger to mother net income for 760 million yuan / 5.0/6.5, year-on-year growth of 36% / 30% / 16%, the current price corresponding valuation for 41/32/27 x. The stable growth of the company's performance, the executives involved in secondary display confidence (issue price of 30.64 yuan per share), can look forward to the development of endogenous extension to this end, covering the first time we have to give the company 17 years EPS35-40 times the valuation, target price of 35-40 yuan, "buy" rating.

Risk tip: consumable bidding price; Hospital channel products not up to expectations.

2 medical instrument platform for enterprises

The company is a leading domestic household medical equipment. In the field of household equipment, the company has more than 50 varieties, nearly 400 kinds of specifications, is the most abundant company product line in domestic counterparts. Including oxygen generator, electronic sphygmomanometer, atomizer, and many other products in the domestic market share in a leading level. Machinery group, to our company for 14 years acquired a wealth of product line of medical equipment and consumables (> 1300 registration certificate), and the future through expand the channels of the hospital, the company will make a household, medical apparatus and instruments marketing platform.

2011-2016 - h1 company revenues and profits steady growth, and formed the home health care, medical clinic, medical breathing and oxygen to the three business sectors.

Are the company's actual control people kuang-ming wu (with wu-group for parent-child relationships), its directly or indirectly holds a 44.57% stake in diving medical.

4.2.2 key product guarantee the sustainable healthy development of the company

The focus of home health care product is electronic sphygmomanometer and glucose meter, relying on the accumulation of brand and channel advantages rapid growth over the last two years. Due to the smaller income base, is expected in the next few years will still remain more than 20% of the growth. Medical clinical income mainly machinery group product contribution, we expect the machinery on the 16th annual income is about 600 million yuan, profit margins of 10%, well below the average net interest rates of 20% for medical devices industry, machinery on future profits side still has larger improvement space, medical breathing and the focus of the oxygen supply products for the oxygen generator, atomizer, and sleep apnea. Oxygen generator and atomizer traditional superior products for the company, the quality and the market widely recognised brand, the future is expected to maintain a 15% - 20% of the industry average growth. Sleep-related breathing machine is 15 years the company listed on the new products, mainly for people suffering from sleep apnea, especially in patients with obstructive sleep apnea syndrome (OSAS), about 80% - 80% of the patients with OSAS in our country have not been diagnosed. At present domestic ventilator permeability in patients with less than 1%, annual sales increment is only around 50000 units, and the permeability in the developed countries breathing machine in patients with OSAS is 13%, so sleep breathing machine in the wide prospect of market. The product 15 years sales of about 7 million, 16 years sales of about 30 million, the future will continue rapid growth. Steady growth in key products is the guarantee of continuous development of company.

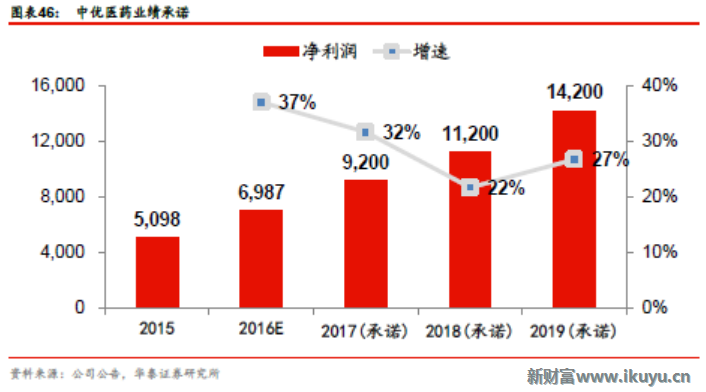

Holdings to buy the best medicine to enhance hospital channel product line

Company in domestic medical equipment channel has become a absolute leader, the next step strategic focus is the development of medical consumables. In the acquisition of medicine is the strategy propulsion. The best medicine is a nosocomial infectious disease prevention and control and the leading enterprise in the field of infection control segment. Acquisition of companies can not only rich in hospital channel product line, and will realize the resource sharing between each clinical products of the company and promote, guarantee the rapid expansion of the company in the field of medical consumables. The trading company will paid about 652 million acquired 61.6225% of optimal, the optimal 2017-19 years of commitment to performance for 9200/11200/14200 yuan. Merger and acquisition has been completed in January, 17 years will bring to the company's performance over the next three years large increase. Good channels of medical development, the future the company will be in the field of the continuous extension of mergers and acquisitions, enrich its product line.

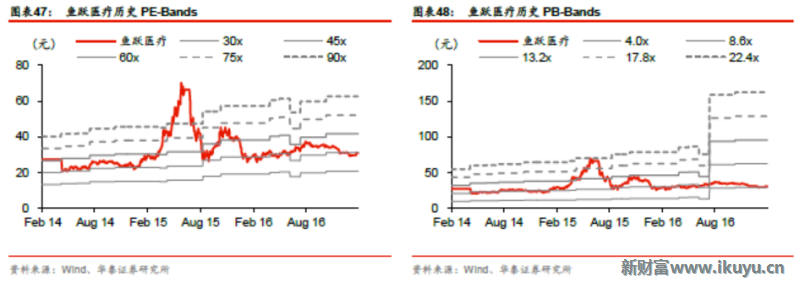

4.2.4 development healthy, attractive valuations, give "buy" rating

We predict the company core business of the existing 2016-18 annual income of 3.26 billion yuan / 26.3/29.4, belong to the mother net income for 690 million yuan / 5.0/6.0. In addition, assume that the new acquisition of optimal medical complete performance commitments, while mother net income for 760 million yuan / 5.0/6.5, year-on-year growth of 36% / 30% / 16%, the current price corresponding valuation for 41/32/27 x. The stable growth of the company's performance, the executives involved in secondary display confidence (issue price of 30.64 yuan per share), can look forward to the development of endogenous extension company current PETTM45 times, 17 years PE32 times, in the past three year low PETTM over the past three years (with the PEForward central is about 60 times and 40 times respectively). Company valuations are attractive, key recommendations.

Through the comparable company valuation analysis, diving medical value in the industry average, but the future net profit growth rate higher than the industry average, shall be given a certain premium valuation. Covering to this end, we first give the company 17 years EPS35-40 times the valuation, the target price of 35-40 yuan, "buy" rating.

Ty: 43 kelly platform of high-value consumables enterprises gaining momentum

Investment point

High-value consumables platform type low valuations, potential

Company is the domestic research and development production vertebral body forming minimally invasive interventional surgery system leading enterprises, through mergers and acquisitions arc with the science and technology, in field of orthopedic implants and cardiovascular stents, becoming the direction of domestic high-value consumables across many product lines in the field of platform type company. Company size is relatively small, in the field of domestic high-value consumables to enhance core competitiveness, the future development potential.

Key products steady growth

Minimally invasive interventional surgery vertebral body forming system products of the company has the technology and brand advantages, vertebral body forming operation exist a large amount of unmet needs in the country. Company's products on the one hand, thanks to the domestic for increased year by year, on the other hand will benefit from the expansion of overseas market, especially the company PKP holds 16 years approved by ministry of Japan, product 17 years is expected to be in the Japanese market. In addition, the company of the orthopaedic products and cardiovascular stents in small Numbers in their respective fields, and there is a big space for import substitution, the future is expected to continue rapid growth.

Acquisition of ningbo deep - bo strengthen channel integration

In the national "two votes" under the background of policy implementation, instrument channel integration is the trend of The Times. Company through the acquisition of deep strategy wins bo makes channels sinks, so that they can maximize provide conditions for product promotion and new product launch, thereby enhancing the company's competitive advantage.

Endogenous extension prospect, for the first time coverage, "overweight" rating

We predict the company core business of the existing 2016-18 annual income of 830 million yuan / 5.7/7.0, belong to the mother net income for 230 million yuan / 1.5/2.0. Moreover, suppose that deep strategy wins bo of the new m&a performance commitment (February 17 years and is expected to table), the merger to mother net income for 280 million yuan / 1.6/2.4, year-on-year growth of 28% / 53% / 16%, the current price corresponding valuation for 47/31/26 times. Considering the company's existing product line good growth potential, in vitro have multiple projects in the breeding, is worth looking forward to the future extension development, for the first time, we cover, give the firm a 17 years after the merger performance EPS33-37 times valuations, target price is $12 to 14, "overweight" rating.

Risk tip: high value consumable bidding price; Instruments channel integration progress than expected; In vitro project progress not exceeding the expectation ".

|